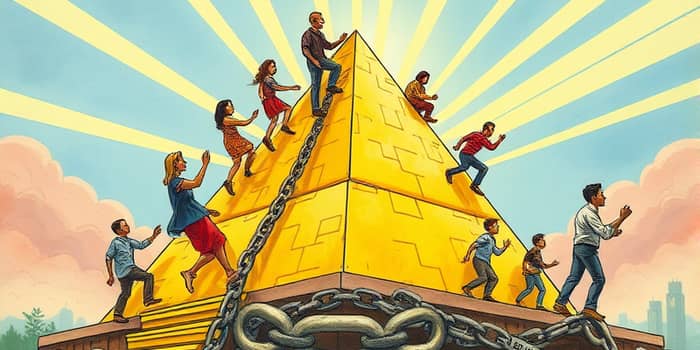

In a world where the richest 1.6% control nearly half of all wealth, millions feel shackled by debt, income gaps, and limited opportunity. This article explores the global landscape of inequality, highlights the transformative power of economic freedom, and offers real-world strategies to reclaim financial independence.

Introduction: The Wealth Gap

The global wealth pyramid reveals a stark reality: 1.6% of adults hold 48% of global wealth, while 82% of adults control just 2–3%. At the summit, Ultra High Net Worth individuals possess $60 trillion, dwarfing the economies of entire nations. Yet, with targeted action, individuals and societies can dismantle barriers and unlock a path to prosperity.

Global Wealth Engines

By the end of 2024, total private financial assets reached an astonishing EUR269 trillion, up 8.7% year-over-year. Despite inflationary pressures, this figure stands at 283% of global economic activity—mirroring levels not seen since 2017.

North America remains the undisputed leader, holding roughly half of these assets. The United States alone accounts for 35% of worldwide wealth and nearly 40% of the world’s millionaires. China, meanwhile, has experienced exponential growth: in the past two decades, the richest 10% hold 67.9% of national wealth—an increase of 17.3 percentage points—while per capita financial assets grew tenfold in real terms.

High Net Worth individuals (>$1 million) now number 41.3 million, and the Ultra High Net Worth segment (> $30 million) has expanded to 510,810, controlling one-third of all millionaire wealth. Projections suggest that by 2030, the UHNW population will swell by 31%, with Asia leading growth and North America remaining the largest region.

Everyday Financial Constraints

Despite record global wealth, household stress is rising. In the United States, 77% of adults report they are not completely financially secure, up from 75% the previous year. Only 23% feel fully secure.

Income expectations have ballooned: 26% of Americans believe they need at least $150,000 annually for security, while 55% say $200,000+ defines feeling wealthy or free. Astonishingly, 39% claim they would need $500,000 or more.

Debt remains a primary burden. For 27% of US and UK adults, being debt-free ranks as the top definition of economic freedom. Meanwhile, negative sentiment about the national economy persists—49% of US adults and 67% of UK adults express discontent, despite pockets of personal optimism.

Gender and generation gaps amplify concerns. Women report lower financial security than men (20% vs. 26%). Gen X exhibits the greatest need for higher income (35% require $150,000+), followed by millennials (26%), baby boomers (24%), and Gen Z (20%). Yet 72% of young adults have taken proactive steps—51% saved more, 24% paid off debt—in response to rising costs.

Economic Freedom as a Catalyst

Economic freedom correlates strongly with prosperity. A Pearson coefficient of 0.71 links freedom scores to per capita GDP, underscoring the power of open markets and low regulatory burdens.

History has borne out the transformative effect of "freedom shocks." Countries that implement swift reforms—deregulation, fiscal discipline, property rights protections—enjoy sustained long-term growth, higher wages, and improved living standards.

Pathways to Financial Liberation

While systemic reforms matter, individual actions can yield immediate impact. Here are practical steps for anyone seeking greater economic freedom:

- Build a solid emergency fund covering 3–6 months of expenses to reduce vulnerability.

- Prioritize high-interest debt payoff to eliminate compounding financial drain.

- Boost financial literacy through courses, books, and reputable online resources; US adults correctly answer only 49% of basic finance questions.

- Automate savings and investments to benefit from dollar-cost averaging and compound interest.

- Advocate for policy reforms that enhance market openness, digital finance access, and gender inclusion.

These steps dovetail with broader initiatives. The IMF’s Financial Access Survey shows expanding digital finance and fintech innovations in 163 economies. As access widens, households gain tools to manage money, borrow responsibly, and plan for the future.

Looking Ahead: Trends and Projections

Global wealth dynamics will continue evolving. By 2030, the UHNW cohort may reach 676,970—an increase of 166,160 individuals from mid-2025. Asia is poised for the strongest growth, while North America maintains its lead in absolute numbers.

However, convergence between advanced and emerging markets has stalled. The ratio of net financial assets fell dramatically, from 67 in 2004 to 18 in 2024, signaling that poorer countries are no longer catching up at historical rates.

This divergence underscores the urgency of targeted reforms and inclusive growth strategies. Nations that embrace economic freedom, invest in human capital, and leverage technology stand to narrow the gap and unlock shared prosperity.

Conclusion: Seizing the Opportunity

The chasm between the ultra-wealthy and the economically pressed may seem insurmountable, but history and data illuminate a path forward. Economic freedom unleashes innovation, educational investments elevate earning potential, and prudent financial habits compound over time. By combining personal initiative with systemic reforms, individuals and societies can break the chains of inequality and chart a course toward a more prosperous, inclusive future.

References

- https://www.encorecapital.com/articles/encore-announces-findings-of-2025-economic-freedom-study/

- https://altrata.com/reports/world-ultra-wealth-report-2025

- https://www.bankrate.com/investing/financial-advisors/financial-freedom-survey/

- https://www.ubs.com/us/en/wealth-management/insights/global-wealth-report.html

- https://www.heritage.org/index/pages/report

- https://www.ubs.com/global/en/wealthmanagement/insights/global-wealth-report.html

- https://www.atlanticcouncil.org/in-depth-research-reports/report/the-path-to-prosperity-the-2025-freedom-and-prosperity-indexes/

- https://www.visualcapitalist.com/the-global-distribution-of-wealth-shown-in-one-pyramid/

- https://www.imf.org/en/news/articles/2025/10/29/pr-25351-imf-releases-the-2025-financial-access-survey-results

- https://www.thinkingaheadinstitute.org/research-papers/tai-global-wealth-study-2025/

- https://www.fraserinstitute.org/studies/economic-freedom-world-2025-annual-report

- https://www.ey.com/en_gl/wealth-management-research

- https://newsroom.bankofamerica.com/content/newsroom/press-releases/2025/07/confronted-with-higher-living-costs--72--of-young-adults-take-ac.html

- https://carry.com/learn/how-financially-literate-is-america-key-stats

- https://www.cato.org/economic-freedom-world/2025