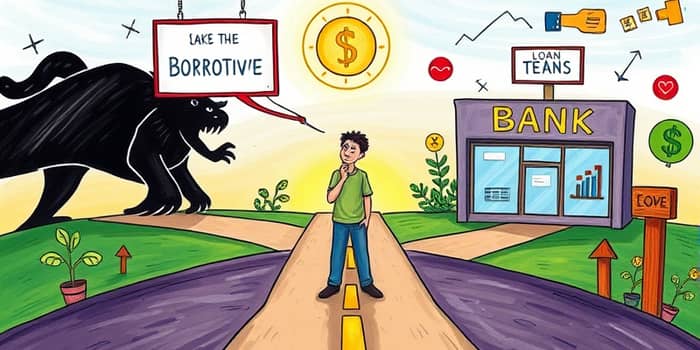

In an era where credit is both a tool of opportunity and a potential trap, every borrowing decision carries weight beyond personal finance. Whether seeking a mortgage, financing a car, or tapping into a personal loan, adopting an ethical borrowing mindset can transform debt from a burden into a pathway toward stability and growth. This article explores how mindful borrowers can shape their futures, influence the lending industry, and contribute to a fairer financial system.

Defining Ethical Borrowing Principles

At its core, making loan decisions that are conscious means aligning borrowing habits with personal capacity and social values. Ethical borrowers commit to honesty on applications, transparency about intended use, and realistic repayment plans. They also research lenders’ reputations, avoiding institutions with hidden fees or exploitative practices. Rather than pursuing maximum credit, they borrow only what is necessary, ensuring obligations fit within household budgets and long-term goals.

Key principles include:

- Honesty and full disclosure when applying for credit.

- Borrowing only amounts that can be reasonably repaid.

- Avoiding predatory lenders while prioritizing sustainability.

- Considering community-based or cooperative financial institutions.

Navigating the Modern Lending Landscape

By 2025, consumer caution has reshaped demand: credit card and personal loan activity declined by 2.8% in the first half of the year, while residential mortgages and HELOCs saw renewed interest. Banks tightened standards across most categories, though auto loan criteria eased slightly as manufacturers offered incentives. Approval is now heavily skewed toward applicants with strong credit scores and low exposure to existing debt.

This environment rewards those who prepare thoroughly. Prospective borrowers should review credit reports, dispute inaccuracies, and consider small secured loans or credit-building products. Understanding that lenders deploy powerful AI algorithms underscores the need for transparent, explainable lending decisions. Asking lenders for clear rationale on approvals or denials helps expose bias and protect consumer rights.

Regulatory Reforms and ESG Integration

Global regulators are responding to both predatory practices and climate concerns by strengthening rules for transparency, interest rate caps, and data privacy. In 2025, new requirements mandate clearer fee disclosures and limit roll-over costs for Buy Now, Pay Later (BNPL) schemes. Digital platforms must now prove algorithmic fairness, with periodic audits to detect bias against protected groups.

Banks are also aligning loan portfolios with Environmental, Social, and Governance (ESG) criteria. Borrowers aiming for green home upgrades or community-impact projects can find specialized “green loans” with favorable terms. These shifts reflect a broader trend toward balancing financial health with social responsibility, where ethical lenders support sustainability goals and borrowers can drive positive environmental outcomes.

Key Statistics and Market Trends

This snapshot highlights how borrower choices and regulatory shifts influence market conditions. Knowing these numbers allows individuals to time applications strategically and select products that align with both budget and values.

Practical Steps for Conscious Borrowing

Transforming theory into action requires a deliberate approach at each stage of the borrowing process:

- Assessment before borrowing: Calculate true cost by factoring interest, fees, and repayment schedules into household budgets. Ask whether alternative funding—savings, grants, or community support—can replace or reduce debt.

- Loan comparison: Use multiple quotes to weigh annual percentage rates, origination costs, and prepayment penalties.

- Ethical lender selection: Choose cooperatives, community banks, or fintech platforms with customer-first reputations.

- Know your rights: Understand data privacy protections, dispute processes, and remedies for unfair treatment.

- Cultivate financial literacy: Engage with tools and educational resources for borrowers such as online courses or nonprofit workshops.

Technology, Transparency, and the Future of Lending

Artificial intelligence and digital platforms are democratizing access but also introducing new risks. Algorithmic lending can speed approvals and tailor rates to individual risk profiles. Yet without oversight, biases can reinforce inequality. Borrowers should request explanations for automated decisions and monitor credit usage through apps that support alerts for payment due dates and fee spikes.

Emerging standards will likely require open-source risk models and third-party audits, ensuring fairness and accountability. Collaborations between regulators, consumer advocates, and fintech firms aim to build systems that protect privacy while delivering fostering long-term financial resilience and trust.

The Ripple Effect of Ethical Choices

Every responsible loan taken sends a ripple through the financial ecosystem. When borrowers prioritize transparency and repay on time, lenders earn the confidence to offer better rates and develop innovative products. Communities benefit as financial institutions allocate capital to socially responsible projects, from affordable housing to renewable energy.

Conversely, overextended or uninformed borrowing perpetuates cycles of high interest, default, and loss of trust. Choosing to be an ethical borrower not only secures personal stability but also empowers others to demand fairness. By championing practices aligned with personal values and societal good, individuals can drive a shift toward a financial future where credit is a true catalyst for opportunity and well-being.

In a world of complex choices and powerful technologies, mindful borrowing is an act of agency. It affirms that credit, wielded with intention and integrity, can be a force for empowerment rather than exploitation. As borrowers, we hold the keys to both our personal destinies and the health of the broader financial system. Let us borrow wisely, repay diligently, and lead the way toward a more equitable tomorrow.

References

- https://www.federalreserve.gov/data/sloos/sloos-202507.htm

- https://www.oncourselearning.com/resources/8-bank-regulatory-trends-2025

- https://www.federalreserve.gov/data/sloos/sloos-202510.htm

- https://blog.flexcutech.com/blog/future-of-lending-trends

- https://www.evlo.co.uk/news/economy/ethical-lending-in-the-digital-age/

- https://www.zest.ai/learn/blog/future-of-lending-ethical-ais-disruptive-potential/

- https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html