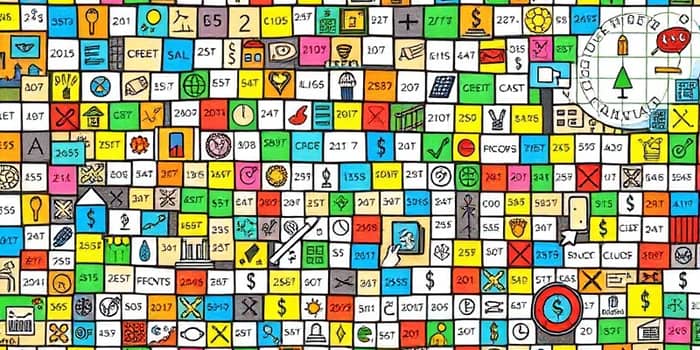

In today’s complex financial landscape, constructing a robust credit profile resembles assembling a work of art—each data point acts as a tile in a grand mosaic. From credit scores and payment histories to demographic insights and green financing options, every fragment contributes to a clear portrait of financial health.

This article guides you through the key pieces, practical strategies, and emerging tools that help you craft a resilient credit future. You’ll learn how to avoid common pitfalls, leverage innovative platforms, and embrace sustainable financing to complete your personal credit mosaic.

Understanding the Credit Mosaic Metaphor

The mosaic metaphor draws from finance’s mosaic theory, where analysts combine public and non-material information from diverse sources to evaluate securities. In the realm of personal credit, you gather public credit reports, demographic data, and alternative metrics to assess your own creditworthiness.

Just as an analyst synthesizes scattered clues into an intricate pattern of financial data, you integrate statements, segment insights, and emerging green loan metrics. This comprehensive approach reveals strengths, gaps, and opportunities often overlooked in a traditional credit assessment.

Key Pieces of Your Credit Mosaic

Building your credit mosaic requires three primary categories of information. Each adds unique color and texture to your overall financial portrait:

When combined, these categories deliver a more nuanced, accurate credit evaluation than any single source alone. They ensure that each tile in your mosaic aligns perfectly.

Personalized Strategies to Build Your Credit

Segmentation frameworks—like Experian’s 207 consumer groups—reveal tailored approaches for different lifestyles. For example, young professionals may focus on establishing credit lines, while retired homeowners prioritize maintaining low utilization.

- Regular monitoring of credit statements and scores

- Strategic use of segment insights for personalized advice

- Incorporating green financing options for impact

First, set up monthly alerts and review your credit reports for accuracy. Early detection of errors prevents stains on your mosaic.

Second, leverage demographic segmentation to identify offers that match your life stage—whether you’re a boomer saving for retirement or a young couple starting a family. This affords a holistic view of credit health tailored to your profile.

Third, explore sustainable credit products, like solar financing, that align with both your values and your repayment capacity. Such options can support sustainable green investments while enriching your overall credit picture.

Leveraging Technology and Tools

Data unification platforms—often called semantic layers—bridge disparate systems into a singular framework of trusted metrics. Tools like Strategy Mosaic enable you to consolidate banking, risk, and compliance data into coherent KPIs without custom coding.

By harnessing diverse sources of non-material data and AI-native modeling, these solutions can reduce business intelligence costs by up to 37% while delivering an explainable view of your financial mosaic. You gain real-time insights into spending trends, projected credit utilization, and risk scenarios under evolving regulations.

Green Financing: A New Color in Your Mosaic

Renewable energy loans—such as those offered by Mosaic—inject fresh vibrancy into your credit tapestry. Since inception, over $7 billion has funded solar and home energy projects, with more than 220,000 homeowners participating.

- PowerSwitch ZERO: customized solar financing

- PowerSwitch CHOICE: flexible pricing options

- PowerSwitch PLUS: tailored home improvement loans

With average loan sizes near $30,000 and competitive rates between 2.49% and 7.99%, these programs allow you to invest in efficiency upgrades or renewable systems. They offer fast approvals and clear terms, but be mindful of installer-driven transparency. Ensure you understand all fees before signing.

By including solar financing, you let sunlight powering your financial growth become a literal and figurative element of your credit profile.

Risks, Compliance, and Future Outlook

Adhering to legal boundaries is critical. The mosaic approach demands careful source vetting to avoid insider trading and pitfalls. Never incorporate material non-public information when evaluating investments or credit products.

Looking ahead, AI-governed semantic layers and advanced analytics will continue to refine how we assemble credit mosaics. Regulatory frameworks—such as Basel III, IFRS 9, and AML directives—will steer data governance and ensure that every tile in your mosaic meets compliance standards. It’s vital to prepare for regulatory changes ahead as frameworks evolve.

Ultimately, piecing together your financial future through a mosaic lens empowers you with clarity, control, and creativity. By integrating multiple data sources, leveraging technology, and embracing sustainable options, you can craft a credit profile that stands resilient against uncertainties and reflects your personal goals.

Begin today: gather your data tiles, explore segmentation insights, and select tools that resonate with your unique financial narrative. Your credit mosaic awaits—ready to reveal a masterpiece of lasting strength and vibrant opportunity.

References

- https://corporatefinanceinstitute.com/resources/valuation/mosaic-theory/

- https://www.ecowatch.com/solar/solar-financing/mosaic-loan

- https://www.strategysoftware.com/strategy-mosaic-for-financial-services

- https://www.wallstreetoasis.com/resources/skills/finance/mosaic-theory

- https://www.experian.co.uk/business/platforms/mosaic